Open Banking and the Application of In-Memory Technologies

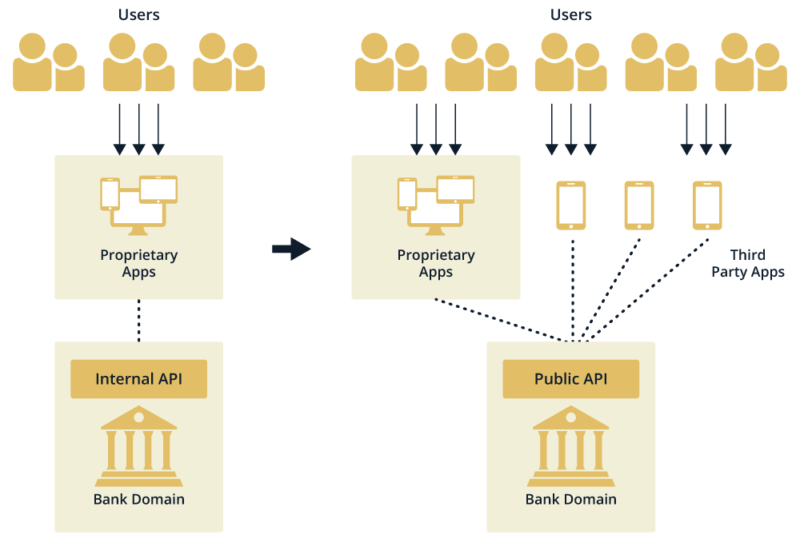

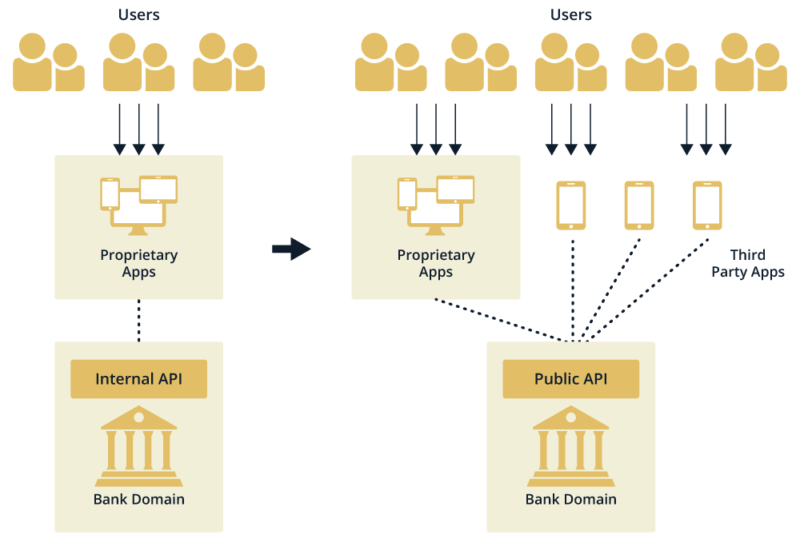

The Open Banking initiative, also referred to as PSD2 (Payment Services Directive), is a textbook example of streaming technology applied to modern banking requirements. In this model, banks (primarily in Europe) are required to make their back-end systems for customer accounts and payment services available to other members of the financial payment ecosystem. While this is a consumer-friendly initiative, from a bank’s perspective the broader transactional ecosystem has effectively been force-integrated into their operational systems.

This essentially means a significant increase in sources of streaming data from a more diverse range of service providers, such as non-bank affiliated mortgage providers, independent credit providers, insurance providers, etc. Financial data sources and transactions that were not part of the bank’s traditional information ecosystem are now entering at high speed, and due to compliance requirements, require monitoring and tracking from an integrated perspective. Just as a bank is looking for a 360° view of their customers, this initiative forces them to develop a 360° view of their entire transactional ecosystem.

Similar to the risks associated with managing a complex series of data sources that pivot around the management of an individual customer (e.g., detecting fraudulent behavior), the same thing applies to an open banking ecosystem—just on a much bigger scale.

Third-party service providers such as Facebook, Apple, or Google will offer their users the opportunity to use their apps to pay bills, transfer money, etc. The funds will remain with the bank, but the bank is now obligated to provide API access to third parties who want to create a financial service using the bank’s data and infrastructure.

This completely changes the competitive landscape for banks, who will now have to cooperate/compete with a completely different type of financial entity, and as a result, the entire payment processing ecosystem is transforming. The PSD framework also creates two new types of financial players; the first is referred to as an Account Information Service Provider (AISP). These are the folks with access to the consumer’s account information which can include account information per consumer for multiple bank accounts. Because the AISPs can create an aggregate perspective on consumer financial behavior, they are also in a great position to run analytics programs to optimize service offerings for ecosystem participants.

The second entity is called a Payment Initiation Service Provider (PISD); they are responsible for executing transactions such as payments or transfers, which means these are the entities consumers will be dealing with directly. While all this sounds great for consumers, it sounds like a real challenge for the banking industry; they are facing increased costs for IT support, a significantly more complex set of security requirements, less control over the customer, and a whole bunch of very deep-pocketed new entities (Google, Apple, etc.) poking around what had been the banks’ private walled garden.

Now banks, of course, are not sitting still. Many are starting to partner with FinTech companies and are experimenting with how to adapt to a radically different environment. The two operational frames of reference for execution are speed and complexity. At its core, Open Banking is an evolution of a payment processing ecosystem; payment processing has always been about speed—it has to be if service providers are expected to process millions of complex transactions per second, with no delay, and with airtight security. The traditional supporting infrastructure for account details (disk-based databases) is as out of place as a horse on a Formula One race track. There has been a steady move by banks and card providers to evolve to an in-memory processing framework because, at its core, in-memory is essentially 1000x faster than a disk-based system, and modern payment ecosystems require a whole different level of performance.

The second aspect is complexity. Until PSD2 came along, everyone in the banking ecosystem had their own little siloed domain and only worried about their specific link in the process. With the advent of Open Banking, banks are now suddenly finding that the walls around their garden are gone. The information about the consumer is suddenly an order of magnitude bigger and more complex, and the system still has to function in real time because it is a payment process. Keeping all this information in RAM (in a data grid) means that instead of worrying about traversing a network to access a database, all relevant information about the consumer can be kept in memory, which now scales to terabytes, and if it’s cloud-based, is essentially unlimited. All of this information is now instantly accessible, but it has to be in-memory. Traditional systems will not work in this model; they don’t support the speed needed, and were never designed for this level of complexity.

This is just one example. In-memory is being used by some of the biggest, most sophisticated players in the global payments ecosystem, which is driving the introduction of a whole new range of innovative services. To see some specific case studies or use cases or to do a deeper dive on in-memory solutions, please click here.